Investing in the stock market can often feel like standing on the edge of a battlefield – the stakes are high, emotions run wild, and the outcome is uncertain. Imagine Arjuna at Kurukshetra, hands trembling with doubt, or a young trader watching the market tumble; the parallels are striking. Ancient Indian mythology is filled with tales of heroes facing tremendous odds, making tough choices, and learning valuable lessons. In this blog, we explore mythology stock market lessons and Indian epic finance lessons, unearthing Bhagavad Gita investing wisdom to bridge ancient guidance and modern investing. For an Indian audience – from novice investors to seasoned professionals – these stories offer a relatable perspective on financial challenges. The Bhagavad Gita’s advice on duty (dharma) and detachment directly mirrors disciplined investing. When Arjuna was paralyzed by fear, Lord Krishna advised him to focus on performing his duty without attachment to the results. In market terms, this means doing your homework and following your plan without panicking over each price swing. Instead of reacting emotionally to price movements, an investor should follow a well-thought-out strategy and let time work its magic.

According to Moneycontrol, Lord Rama’s unwavering commitment to dharma serves as the foundation of sustainable wealth. Both epics and financial experts emphasize that ethical, long-term thinking pays off. By drawing on these ancient epics, this blog shows how mythological insights can guide today’s Indian investors toward smarter, calmer decision-making.

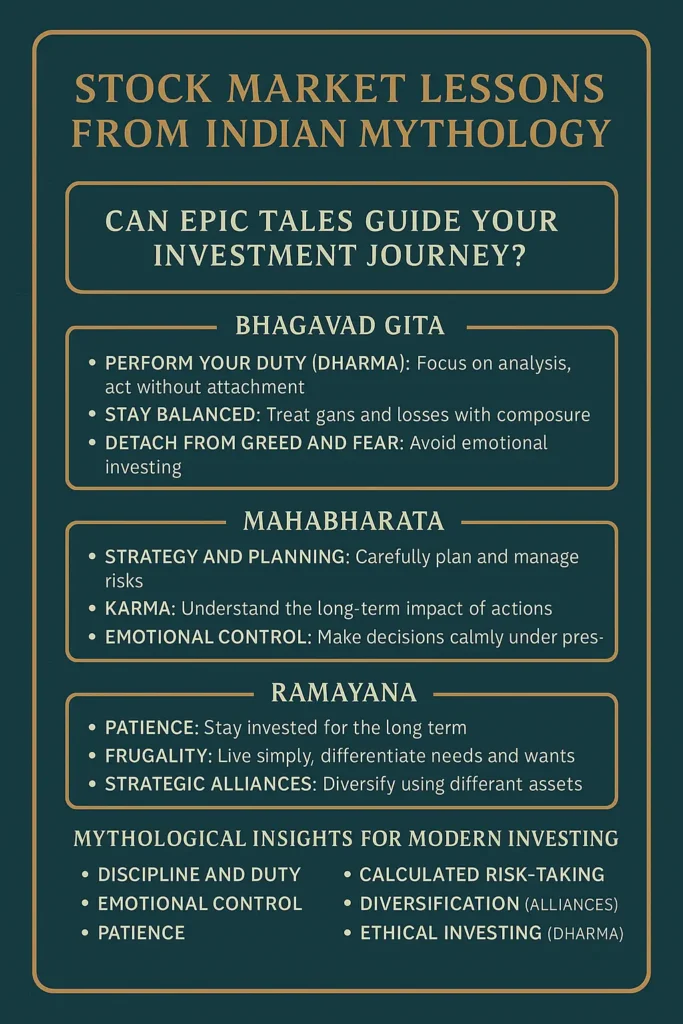

Bhagavad Gita: Duty, Discipline & Emotional Balance

In the Mahabharata’s Bhagavad Gita, Krishna teaches Arjuna about performing one’s duty with a calm mind. Translated to finance, this means focus on what you can control (your analysis and actions) and detach from unpredictable market results. According to The Economic Times, investor Rishabh Nahar notes that market fear and greed often “take the wheel,” but reflecting on Gita wisdom helps him stay grounded. When Arjuna was overwhelmed, Krishna’s guidance got him to refocus on his role and act with purpose. By analogy, a trader who obeys his “dharma” – consistently doing research and managing risk – can avoid panic during a market crash.

Another key lesson from the Gita is equanimity in success and failure. ETMarkets.com highlights the verse: “A person who is not disturbed by the ups and downs of life, who remains equanimous in success and failure, is truly wise” (Bhagavad Gita 2.14). For investors, this teaches us to avoid euphoria in booming markets and despair in downturns. Instead, maintain a steady approach: adhere to your investment strategy, contribute regularly, and review your goals periodically. By keeping a balanced mindset, one treats success and failure as part of the journey, not as an emotional swing.

Key takeaways from the Gita for investors include:

- Perform your duty (Dharma): Follow a clear investment plan and do the required homework (research, diversification), knowing you cannot control market swings.

- Stay balanced: Treat gains and losses with composure. The Gita teaches that true wisdom is remaining steady in both prosperity and adversity.

- Detach from greed and fear: Avoid chasing every market rumor or panic-selling. As one expert notes, the Gita’s lessons helped him stay grounded during volatility.

The Gita’s lessons also emphasize karma yoga – doing work selflessly – which in investing terms means focusing on the process (due diligence and disciplined action) rather than fixating on gains. Modern traders often use checklists or routines to reduce mistakes; this is akin to following a daily discipline (niyama) just as Krishna advises a yogi to follow spiritual disciplines. By internalizing these principles, an investor can treat both success and failure as part of the journey, not as an emotional swing.

Mahabharata: Strategy, Karma & Risk Management

The Mahabharata is a saga of strategy, ethics, and consequences – concepts every investor understands. One famous episode is Yudhishthira’s game of dice, where he gambled away his kingdom in a single risky bet. This is a cautionary tale: never bet everything on one outcome. In investing terms, it warns us not to put all our money into a single stock or speculation. Instead, manage risk by diversifying across different sectors and asset classes.

Careful planning is also a constant theme. Lord Krishna spent years forging alliances and devising tactics before the great war. Likewise, an investor should plan for various scenarios and seek advice. The Pandavas’ success stemmed from their diverse alliances and counsel, rather than acting alone. This suggests modern portfolios should be diversified – like having multiple allies: a mix of stocks, bonds, and other assets means one weakness won’t topple your entire plan. In contrast, those who relied on a single plan often suffered. Even after heavy losses (for example, falling victim to a market crash), one can regroup and recover by learning and adjusting one’s strategy.

Another important concept is karma – the idea that actions have consequences. In finance, this translates to the long-term impact of consistent behavior. For instance, disciplined saving and investing (good karma) tends to yield wealth over time, whereas impulsive or unethical moves (bad karma) can lead to setbacks. Indian epics stress integrity: as Moneycontrol highlights, Lord Rama’s commitment to dharma provided the foundation for sustainable prosperity. In practice, it means staying honest and focused – for example, investing with clear goals instead of chasing speculative bets.

The Mahabharata also emphasizes emotional control. Just as Arjuna felt paralyzed by the sight of battle, investors can be frozen by fear during a market crash. The Gita’s guidance offers help. When Arjuna’s doubt gave way to duty, he acted with clarity. Similarly, a modern investor who calms panic can make better decisions. Rishabh Nahar explains that he applies Krishna’s lesson by “focusing on long-term goals and strategy, rather than reacting to short-term market shifts driven by fear or greed”. Even legendary warriors needed a cool head; so do investors. Overconfidence also proved costly in the epic – for example, Duryodhana’s pride led to his downfall. For investors, this reminds us that arrogance is dangerous, but humility (like that learned by the Pandavas during exile) can strengthen one’s resolve. If a setback occurs, studying the mistake and adjusting can lead to future wins.

Ramayana: Patience, Frugality & Long-Term Focus

The Ramayana offers valuable lessons in patience, simplicity, and perseverance. Lord Rama endured 14 years of exile in the forest with grace and resilience. He adapted to a simple life, never complaining or making panic-driven choices; instead, he remained focused on the goal of protecting dharma and his loved ones. This patience is directly applicable to investing. Markets will have seasonal ups and downs, but those who stay invested patiently often reap rewards. As Moneycontrol observes, Rama’s actions symbolized “patience, perseverance, and protection of hard-earned money,” guiding investors through fluctuations. A disciplined investor knows that markets will recover over time, so holding steady often pays off.

Rama’s frugality and discipline are also instructive. With limited resources in the forest, Rama, Sita, and Lakshmana managed carefully – they hunted or gathered food only as needed and avoided waste. Moneycontrol notes that this simple lifestyle teaches frugality and financial discipline. In practice, this means budgeting wisely, living within your means, and building savings. By differentiating between needs and wants (as Rama did in exile), individuals can accumulate a security fund that supports investment over the long run.

The Ramayana shows strategic planning and alliances too. When Sita was kidnapped, Rama did not rush recklessly; he sought out Hanuman and the Vanara (monkey) kingdom to form a strong alliance. In finance, this is like diversifying your portfolio. Just as Rama combined forces of monkeys, bears, and even birds (the mythical Jatayu) to reach Lanka, investors can spread risk across different sectors and asset classes. As Moneycontrol highlights, Rama’s final battle “highlights the importance of courage and risk management” – taking calculated risks is necessary for achieving big goals. In investing terms, this means doing research and taking a smart position (for example, buying a promising stock) while having safeguards (stop-loss orders, diversification) in place.

Even Hanuman’s legendary leap to Lanka has a financial analog. Hanuman’s journey was daring – he crossed hundreds of miles on faith and strength – yet he was prepared: he had divine gifts and a clear mission. The lesson is that sometimes big rewards require bold action, but it must be backed by preparation. In investment terms, a “Hanuman strategy” means doing thorough due diligence before making a bold move. Just as Hanuman had confidence in his abilities, investors should only take significant risks when they have studied their investments and prepared for possible obstacles.

Another insight from the Ramayana is setting boundaries. Lakshmana drew a protective line – the famous Lakshmana Rekha – and warned Sita not to cross it. This boundary was meant to safeguard her. Similarly, investors should define their own risk thresholds. Know how much loss you can tolerate and stick to those limits. Crossing that personal “Lakshmana Rekha” can lead to trouble; staying within it keeps your portfolio secure. For example, if a stock’s drop exceeds your risk limit, it may be time to exit. On the positive side, Sita’s patience during her exile reminds us that markets too can recover from downturns. She endured hardship and was eventually reunited with Rama after years apart, illustrating that perseverance through a bear phase can lead to a rewarding outcome.

Mythological Insights for Modern Investing

Across these epic tales, certain investment themes repeatedly emerge:

- Discipline and Duty: Heroes stick to their dharma (duty) through chaos. Likewise, disciplined investors follow a plan, contribute regularly, and rebalance their portfolios.

- Emotional Control: Mythology warns against being swayed by emotion. Krishna’s counsel teaches equanimity. By keeping a balanced mind during market swings, investors make rational choices instead of reactive ones.

- Patience: Success in the epics often requires waiting. Rama’s exile patience or Sita’s endurance in captivity remind us that patience can turn situations around. Moneycontrol emphasizes that patience and perseverance guide long-term wealth. In practice, this means holding investments through volatility to allow time for growth.

- Calculated Risk-Taking: Courage is celebrated, but always with strategy. Rama and Arjuna didn’t act recklessly; they planned their moves. Moneycontrol notes that the Ramayana highlights “courage and risk management” for big goals. For investors, this means taking informed risks (like entering a high-growth sector) with research, while using tools like stop-loss orders as safety nets.

- Diversification (Alliances): While epics don’t say “diversify,” they stress unity of different strengths. Rama’s success came from his multi-skilled army, and the Pandavas had five brothers bringing varied talents. This is akin to diversifying assets: spreading investments across sectors or asset classes so no single setback topples everything.

- Ethical Investing (Dharma): Integrity is the cornerstone of epic heroes. Moneycontrol notes Rama’s dharma leads to fulfilling wealth. In finance, follow this dharma by choosing reputable companies and avoiding “too good to be true” schemes. Good karma in investing comes from diligence and honesty, which pave the way for stable, long-term growth.

- Continuous Learning: Even epic heroes trained and learned from gurus. Arjuna studied under Dronacharya, and Rama sought counsel from sages. Similarly, successful investors continually educate themselves – reading financial books, following market news, or consulting mentors to stay sharp.

Even modern investing ideas find echoes in mythology. For instance, mindful investing – staying present and non-reactive – is essentially Gita’s equanimity applied to finance. Legendary investor Warren Buffett also preaches patience: he reminds us that “the stock market is a device to transfer money from the impatient to the patient.” In other words, focusing on a sound strategy (not luck) aligns with Krishna’s teaching on duty. By combining these myth-inspired values with contemporary tools like analysis and research, investors can navigate markets more calmly and confidently.

Conclusion

Indian mythology offers more than drama and adventure; it provides time-tested wisdom for life’s challenges, including investing. The Bhagavad Gita teaches us to act without being swayed by emotional highs or lows. The Mahabharata reminds us to plan diligently and face the consequences of our actions. The Ramayana highlights endurance, simplicity, and righteous conduct. By being disciplined like Arjuna, patient like Rama, and bold yet prudent like Hanuman, modern investors can build a strong mindset. After all, markets may fluctuate, but human nature doesn’t change. By channeling a bit of Krishna’s calm, Rama’s perseverance, and Hanuman’s courage, investors can navigate volatility more confidently. In investing – as in these epics – duty, patience, and ethics often win the long game, whereas hasty shortcuts can lead to ruin. Sometimes the best financial advice comes from a story told around an ancient fire thousands of years ago. May these epic lessons remind you that investing, at its heart, is as much about character as it is about numbers.

Frequently Asked Questions

What Bhagavad Gita investing wisdom can I apply today?

The Gita advises focusing on your duty and not fixating on results. For investors, this translates to doing thorough research and sticking to your plan, without panicking over short-term market swings. It also teaches equanimity: remaining steady through both gains and losses. This approach, emphasizing a process-over-outcome mindset, can greatly reduce investor stress.

How do Indian epics like the Mahabharata influence modern finance?

These epics emphasize strategy, ethics (dharma), and the consequences of actions (karma). For example, the Mahabharata warns against reckless gambles and highlights careful planning. According to [Moneycontrol], Lord Rama’s commitment to dharma in the Ramayana underscores that ethical actions and patience build lasting wealth. In practice, it means diversifying, planning, and investing for the long term.

What mythology stock market lessons does the Ramayana teach?

The Ramayana teaches patience and frugality. Rama’s calm endurance during exile and simple lifestyle illustrate disciplined saving and long-term focus. His strategic use of allies (monkeys, bears, etc.) suggests valuing diverse strengths – much like a diversified portfolio. In short, it encourages steady, ethical investing and waiting for the right opportunities.

How can discipline and patience from mythology improve my investing?

Discipline and patience are virtues highlighted throughout these stories. By setting a clear goal (your dharma) and sticking to it, you avoid rash moves. Patience allows your investments time to grow through market cycles. For instance, staying invested during downturns (like Rama waiting through exile) often leads to better outcomes compared to constantly switching strategies.

Why is emotional balance important in investing according to these myths?

Mythology teaches heroes to maintain focus despite fear or excitement. Krishna’s counsel to Arjuna emphasizes equanimity, meaning don’t let success or failure overly excite or devastate you. In markets, greed can lead to speculation, and fear can cause selling at the bottom. Controlling these emotions (as the Gita suggests) helps investors act logically and stick to their plan.

What risk-taking advice can we learn from Hanuman or Arjuna?

Both epics endorse calculated bravery. Hanuman’s leap to Lanka was bold but based on confidence in his preparation. Rama and Arjuna took risks with strategic support. Moneycontrol highlights that Rama’s battle shows “courage and risk management” are needed for big goals. The takeaway: take informed risks when justified (like investing in a promising venture) but prepare thoroughly (research, safety nets) rather than gambling blindly.

How do Indian epics suggest diversifying investments?

The epics stress unity of diverse strengths. Rama’s success came from uniting monkeys, bears, and more, while the Pandavas had five brothers with different talents. This mirrors diversifying a portfolio: spreading investments across sectors or assets so no single setback sinks everything. In mythology, relying on one plan often led to defeat, whereas combining strengths led to victory.

What does ‘dharma’ mean for my finances?

Dharma implies righteousness and duty. In finance, this means honest, disciplined behavior. [Moneycontrol] highlights Lord Rama’s dharma as the foundation of success. For your money, dharma could mean saving regularly, investing ethically (choosing reputable companies), and avoiding dubious “get-rich-quick” schemes. Good dharma in finance lays the groundwork for steady growth.

Can ancient wisdom really apply to modern stock trading?

Absolutely. Markets are driven by human behavior, which hasn’t changed. Traits like patience, discipline, and courage praised in myth are exactly what smart investors cultivate. As experts note, applying Gita’s principle of detachment and Rama’s patience, alongside today’s tools, helps make more rational, long-term decisions.

What practical investing tips come from Indian epics?

Think of your financial journey like a mythic quest. Set clear goals (your dharma) and create a plan. Diversify your “army” of investments (stocks, bonds, etc.) as heroes gathered allies. Stay patient in tough times (like Rama’s exile). Control greed and fear (Krishna’s equanimity). Invest ethically and avoid shortcuts (Rama’s dharma). Following these time-honored principles can make your stock market journey steadier and more successful.

Disclaimer: The information provided on this website is for informational purposes only and should not be construed as financial or investment advice. Users are advised to do their own research and consult a qualified financial advisor before making any investment decisions.