The Bank Nifty index presents a complex technical landscape as of July 29, 2025, with the banking sector benchmark trading at 56,528.90, displaying pronounced bearish momentum following disappointing quarterly earnings from key banking constituents. This comprehensive analysis examines the critical support and resistance levels, sectoral headwinds, and market dynamics that will likely influence the index’s movement during this pivotal trading session.

Current Market Position and Technical Overview

The Bank Nifty has experienced significant deterioration in its technical structure, declining approximately 1,100 points from its recent high of 57,628.40 reached in early July. The index currently trades at 56,528.90, representing a 0.94% decline from the previous session and marking the third consecutive day of losses1. This sustained selling pressure has pushed the index below several key technical levels, signaling a shift from the previous bullish momentum to a more cautious bearish environment.

Also Read:

- Sensex Technical Analysis and Prediction for July 29, 2025

- Nifty 50 Technical Analysis and Prediction for July 29, 2025

The index’s recent performance has been particularly impacted by weak quarterly results from major banking constituents, most notably Kotak Mahindra Bank, which reported a significant 40% year-over-year decline in net profit, triggering a 6-7% decline in its stock price23. This earnings disappointment has created a ripple effect across the banking sector, contributing to the broader index weakness.

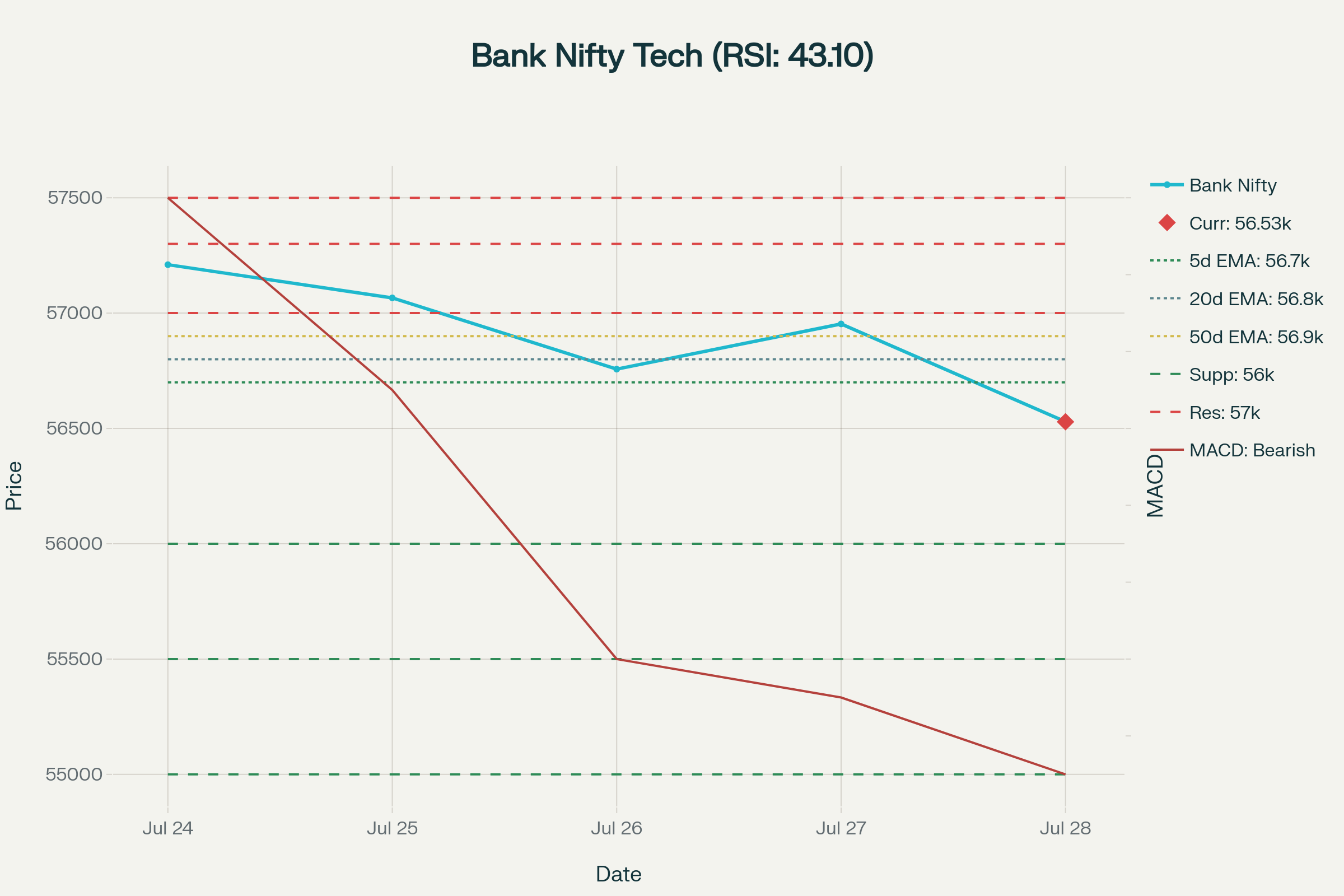

Bank Nifty Technical Analysis Chart – Key Support and Resistance Levels for July 29, 2025

Technical Indicators Analysis

Moving Average Configuration

The technical analysis reveals a deteriorating moving average setup that underscores the weakening market structure. The Bank Nifty currently trades below several key moving averages, with the 5-day EMA acting as immediate resistance around 56,700 levels. The 20-day and 50-day EMAs, positioned at approximately 56,800 and 56,900 respectively, represent significant overhead resistance that will need to be reclaimed for any meaningful recovery4.

This configuration, where the price trades below short-term moving averages with declining momentum, indicates a classic bearish trend development. The crossover of shorter-term averages below longer-term ones has generated additional selling signals, reinforcing the negative technical outlook for the near term.

Momentum Oscillators

The Relative Strength Index (RSI) at 43.10 indicates that the index is approaching oversold territory but has not yet reached extreme levels4. This reading suggests that while selling pressure has been significant, there may be limited immediate relief from technical oversold conditions. The RSI’s position below the neutral 50 level confirms the bearish momentum but also indicates potential for a technical bounce if the index approaches the 30 oversold threshold.

The Moving Average Convergence Divergence (MACD) indicator presents a strongly bearish picture, with technical analysis showing bearish crossovers and negative momentum readings4. The MACD’s position below its signal line indicates accelerating bearish momentum, suggesting that the downtrend may continue in the near term without intervention from external supportive factors.

Volume Analysis and Market Breadth

Trading volumes have remained elevated during the recent decline, with significant institutional activity observed in banking stocks. The volume patterns suggest genuine selling pressure rather than mere profit-taking, as evidenced by the sustained high volumes accompanying price declines. This institutional selling has been particularly pronounced in private sector banking stocks, with market breadth deteriorating significantly across the banking space.

The option chain analysis reveals significant put writing at the 56,000 level, indicating strong institutional support at this psychological level5. Conversely, call writing has been observed at the 57,000 level, suggesting that any recovery towards this level is likely to face fresh resistance from option writers.

Critical Support and Resistance Levels

Immediate Support Zones

The immediate support for Bank Nifty is positioned at 56,000, which represents both a psychologically important level and a zone where significant put open interest has accumulated6. This level has been identified by multiple technical analysts as a critical floor, with option chain data supporting its significance through elevated put writing activity.

Below the 56,000 level, the next substantial support lies at 55,500-55,000, representing a zone that coincides with longer-term technical support levels and previous consolidation areas7. A decisive break below 55,000 could trigger additional selling pressure, potentially driving the index toward the 54,470-54,375 zone, which has been identified through pattern analysis as a key support area8.

Key Resistance Levels

On the upside, the index faces immediate resistance at 57,000, which has been reinforced by significant call writing activity at this strike price6. This level represents not only a technical resistance but also a psychological barrier where fresh selling pressure is likely to emerge.

The more substantial resistance is positioned at 57,300-57,500, representing the convergence of multiple technical factors including prior support turned resistance and moving average resistance6. A sustained move above 57,500 would be required to signal a potential trend reversal and attract meaningful buying interest from institutional participants.

Banking Sector Earnings Impact

Quarterly Results Analysis

The Q1 FY26 earnings season has revealed significant stress in the banking sector, with mixed results from major constituents. Kotak Mahindra Bank’s disappointing performance, showing a standalone net profit decline of 7% year-over-year to ₹3,282 crore, has been a major catalyst for the sector’s weakness29. The bank attributed this decline to margin compression due to RBI rate cuts, slower fee income growth, and elevated provisions.

Other banking constituents have also reported challenging results, with IDFC First Bank showing a 32% decline in net profit to ₹463 crore, primarily due to slippages in the microfinance book10. Even stronger performers like Bank of Baroda, which reported modest profit growth, faced margin pressures and asset quality concerns.

Asset Quality Concerns

The banking sector is facing emerging stress in asset quality, particularly in unsecured retail loans and microfinance portfolios11. Recent regulatory reports have highlighted concerns about rising write-offs in private sector banks’ retail loan portfolios, which may be masking underlying asset quality deterioration11. This trend is particularly concerning for banks with significant exposure to unsecured lending segments.

The Reserve Bank of India’s latest Financial Stability Report projects that gross non-performing assets (NPAs) of banks will worsen to 2.5% in March 2027 from current levels, though the banking sector remains well-capitalized12. However, stress tests indicate that under adverse scenarios, banking asset quality could deteriorate to 5.6%, which would significantly impact sector profitability.

Institutional Activity and Market Sentiment

Foreign and Domestic Institutional Flow

Foreign Institutional Investor (FII) selling pressure continues to weigh heavily on the banking sector, with FIIs remaining net sellers for consecutive sessions. The sustained FII outflow of approximately ₹36,591 crore during July has created persistent selling pressure across banking stocks1314. This selling has been broad-based, affecting both large-cap and mid-cap banking names.

Conversely, Domestic Institutional Investors (DIIs) have provided crucial support, with net buying of ₹46,590.52 crore during July, helping to absorb some of the FII selling pressure14. However, this divergence between FII selling and DII buying indicates ongoing uncertainty about the sector’s near-term prospects among foreign investors.

Derivative Market Positioning

Option chain analysis reveals a defensive positioning among market participants, with significant put buying observed at lower strike prices and call writing at higher levels5. The maximum pain level for Bank Nifty has been identified around 56,400, suggesting that options market positioning supports current price levels5.

The put-call ratio (PCR) analysis indicates elevated put buying activity, reflecting bearish sentiment among options traders. This positioning suggests that any recovery attempts are likely to face resistance from options-related hedging activities.

Global Market Context and Sector Outlook

International Banking Sector Trends

Global banking sector sentiment has been mixed, with concerns about rising interest rates, credit quality, and economic slowdown affecting investor confidence. The recent trade negotiations between the US and various countries, including the EU-US agreement reducing tariffs to 15%, have provided some positive sentiment, though India’s trade talks remain stalled15.

The Federal Reserve’s upcoming policy decision on July 30 will be closely watched, as any changes in US monetary policy could impact global banking sector flows and emerging market banking stocks16.

Regulatory Environment

The Indian banking regulatory environment remains supportive, with the RBI’s recent policy stance being accommodative. However, ongoing concerns about asset quality, particularly in unsecured retail segments, continue to weigh on sector sentiment11. Recent regulatory focus on microfinance lending and risk weights has also contributed to uncertainty in the sector.

Predictions and Trading Strategy for July 29, 2025

Intraday Outlook

Based on the comprehensive technical analysis, Bank Nifty is likely to experience continued pressure on July 29, 2025. The index is expected to face immediate resistance at 56,800-57,000, with any rally likely to be met with fresh selling pressure from both technical and options-related factors.

The critical support at 56,000 will be closely watched, as a breakdown below this level could accelerate the decline toward 55,500-55,000. The technical setup suggests a trading range between 55,500-57,000 for the session, with a bearish bias given the momentum indicators and sectoral headwinds.

Key Inflection Points

July 29 represents a crucial inflection point for the banking sector, with multiple technical and fundamental factors converging. The interaction between the current price level and the critical support at 56,000 will likely determine near-term direction. A decisive break below 56,000 with sustained volume could trigger a more significant correction toward 55,000-54,500.

Conversely, any bounce from current levels might provide temporary relief toward 56,800-57,000, but such moves are likely to be viewed as selling opportunities given the prevailing negative sentiment.

Risk Management Considerations

Given the elevated volatility and uncertain sectoral conditions, risk management becomes paramount for traders. Position sizing should be conservative, with clearly defined stop-loss levels. Long positions should consider stops below 55,800, while short positions might target the 55,000-54,500 zone with stops above 57,200.

The high implied volatility in banking stocks suggests that option strategies might be more effective than directional bets in the current environment. Iron condor or range-bound strategies might be more appropriate given the expected consolidation between key levels.

Medium-Term Technical Outlook

Weekly and Monthly Perspective

From a broader perspective, Bank Nifty has completed its third consecutive week of losses, with the weekly chart showing increasing bearish momentum. The monthly chart indicates that July 2025 could be one of the weaker months for the banking sector, breaking a previous upward trajectory.

The index’s position relative to its long-term moving averages suggests that any recovery will likely be gradual and face multiple resistance levels. The 57,500-58,000 zone represents a significant resistance area that would need to be reclaimed for a meaningful trend reversal.

Sectoral Rotation Implications

The current weakness in banking stocks coincides with relative strength in defensive sectors like pharmaceuticals and FMCG. This sectoral rotation suggests that investors are becoming more risk-averse and seeking defensive positioning amid economic uncertainty.

The upcoming earnings season will continue to influence sector performance, with focus shifting to asset quality metrics, margin trends, and management commentary on credit growth prospects.

Conclusion

The Bank Nifty’s technical analysis for July 29, 2025, presents a predominantly bearish outlook characterized by deteriorating technical indicators, sectoral earnings disappointments, and sustained institutional selling pressure. While the RSI approaching oversold levels suggests potential for a technical bounce, the overall trend structure remains negative with significant resistance levels capping any recovery attempts.

The critical support at 56,000 and resistance at 57,000 will define the near-term trading range, with a breakdown below support likely to accelerate the decline toward deeper correction levels. Market participants should remain cautious and employ appropriate risk management strategies while navigating this challenging technical and fundamental environment.

The confluence of weak earnings results, asset quality concerns, global trade uncertainties, and persistent FII selling creates a complex backdrop that favors defensive positioning over aggressive bullish bets. Any trading decisions should carefully consider the elevated volatility and the potential for continued weakness in the banking sector, while remaining alert to any positive catalysts that could emerge from policy support or improving global sentiment.

- https://www.perplexity.ai/finance/^NSEBANK

- https://www.ndtvprofit.com/markets/trade-setup-for-july-29-nifty-support-moves-to-24500-levels-after-third-straight-day-of-decline

- https://enrichmoney.in/bank-nifty-news-research-analysis-chart

- https://munafasutra.com/nse/ma/nifty_bank

- https://www.spidersoftwareindia.com/blog/stock-market-prediction-for-nifty-bank-nifty-29th-july-2025/

- https://www.topstockresearch.com/rt/Stock/BANKNIFTY/TechnicalAnalysis/

- https://stolo.in/analysis/nifty-banknifty-support-and-resistance/

- https://www.cnbctv18.com/market/trade-setup-july-29-nifty-enters-oversold-territory-but-positive-triggers-remain-elusive-indusind-bank-shares-19644829.htm

- https://munafasutra.com/nse/tomorrow/NIFTY_BANK

- https://www.topstockresearch.com/rt/Stock/BANKNIFTY/PivotPoint

- https://www.youtube.com/watch?v=FSM5ZCyXkgE

- https://in.tradingview.com/symbols/NSE-BANKNIFTY/technicals/

- https://earnometer.com/sector-index-performance/BANKNIFTY.html

- https://www.youtube.com/watch?v=qWEnax6rxVo

- https://in.investing.com/indices/bank-nifty-technical

- https://www.equitypandit.com/share-price/today/bank-nifty

- https://www.youtube.com/watch?v=FR2SxijwknU

- https://dhan.co/indices/nifty-bank-share-price/

- https://in.tradingview.com/ideas/supportandresistance/

- https://www.moneycontrol.com/news/business/markets/nifty-bank-index-today-live-updates-29-july-2025-13340562.html

- https://www.moneycontrol.com/technical-analysis/indian-indices/nifty-bank-23

- https://www.reddit.com/r/IndianStreetBets/comments/1m9wuub/bank_nifty_option_chain_analysis_insights/

- https://www.editorji.com/business-news/markets/indian-stock-market-sectorwise-performance-which-sector-is-performed-well-today-july-28-2025-1753699019399

- https://munafasutra.com/nse/FIIDII/

- https://bigul.co/blog/market-update/nifty-50-and-bank-nifty-outlook-for-july-25-2025

- https://www.research360.in/fii-dii-data

- https://bigul.co/blog/market-update/nifty-50-and-bank-nifty-outlook-for-july-24-2025

- https://www.nseindia.com/reports/fii-dii

- https://stocktwits.com/news-articles/markets/equity/nifty-levels-to-watch-july-28/choe907R5DP

- https://www.optionchainindia.com/blog/technical-analysis-4/24th-july-25-110

- https://groww.in/fii-dii-data

- https://in.investing.com/indices/s-p-cnx-nifty-technical

- https://in.investing.com/indices/bank-nifty-futures-technical

- https://www.moneycontrol.com/stocks/marketstats/fii_dii_activity/index.php

- https://www.nseindia.com/get-quotes/derivatives?symbol=BANKNIFTY&identifier=FUTIDXBANKNIFTY27-03-2025XX0.00

- https://web.stockedge.com/fii-activity

- https://www.equitypandit.com/list/banknifty-companies

- https://www.moneycontrol.com/news/business/markets/trade-setup-for-july-29-top-15-things-to-know-before-the-opening-bells-13339587.html

- https://www.kotaksecurities.com/financial-results/kotak-mahindra-bank-ltd-q1fy2025-26-results/

- https://univest.in/blogs/kotak-mahindra-bank-q1-results-fy26

- https://in.tradingview.com/ideas/banknifty/

- https://timesofindia.indiatimes.com/business/india-business/kotak-mahindra-bank-q1-results-profit-slips-7-yoy-retail-cv-stress-high-provisions-weigh-on-earnings/articleshow/122926485.cms

- https://upstox.com/news/market-news/earnings/bank-of-baroda-kotak-mahindra-bank-idfc-first-bank-how-key-banking-names-fared-in-q1-fy-26-top-takeaways/article-178726/

- https://upstox.com/news/market-news/stocks/nifty-50-sensex-extend-losses-in-midday-session-kotak-mahindra-tcs-tata-motors-among-buzzing-stocks/article-178747/

- https://www.angelone.in/news/idfc-first-bank-vs-yes-bank-vs-axis-bank-comparing-q1-fy26-earnings-results

- https://economictimes.com/markets/stocks/earnings/kotak-bank-q1-results-pat-falls-7-yoy-to-rs-3282-crore-nii-up-6/articleshow/122919655.cms

- https://www.business-standard.com/companies/quarterly-results/fy26-q1-results-today-july-24-kotak-mahindra-idfc-first-whirlpool-sbfc-125072600177_1.html

- https://www.financialexpress.com/market/stock-insights/hdfc-bank-vs-kotak-vs-axis-a-head-to-head-battle-of-the-q1-bank-results/3927423/

- https://www.cnbctv18.com/market/earnings/q1-results-live-updates-kotak-bank-cdsl-indusind-bel-torrent-gail-mazadon-dock-sbi-cards-upl-share-price-liveblog-19644345.htm

- https://in.tradingview.com/symbols/NSE-BANKNIFTY/ideas/?sort=recent

- https://www.moneycontrol.com/financials/kotakmahindrabank/results/quarterly-results/KMB

- https://www.cnbctv18.com/market/indusind-bank-q1-results-live-updates-profitability-asset-quality-loss-core-income-slippages-new-md-ceo-funds-share-price-liveblog-19644418.htm

- https://www.ndtvprofit.com/markets/stocks-to-watch-today-kotak-mahindra-bank-aadhar-housing-petronet-lng-adani-green-bank-of-baroda

- https://www.idfcfirstbank.com/content/dam/idfcfirstbank/pdf/financial-results/Investor-Presentation-Q1FY26-Final.pdf

- https://upstox.com/option-chain/banknifty/

- https://www.niftytrader.in/banknifty-intra-volume-pcr-trend

- https://economictimes.com/markets/stocks/news/banking-sector-outlook-2025-suresh-ganapathys-perspective-on-growth-and-valuations/sector-insights/slideshow/119120700.cms

- https://www.optionchainindia.com/blog/technical-analysis-4/29th-july-25-116

- https://www.moneycontrol.com/news/business/banks/moody-s-says-outlook-for-india-s-banking-system-is-stable-12962848.html

- https://www.youtube.com/watch?v=XZkjpQVpJrA

- https://in.investing.com/indices/bank-nifty-historical-data

- https://economictimes.com/markets/expert-view/goldman-sachs-revises-banking-sector-outlook-expects-10-12-credit-growth-better-profitability-rahul-jain/articleshow/120548953.cms

- https://www.nseindia.com/get-quotes/derivatives?symbol=BANKNIFTY

- https://www.nseindia.com/market-data/most-active-underlying

- https://www.statista.com/outlook/fmo/banking/india

- https://groww.in/indices/nifty-bank

- https://www.icra.in/Rating/DownloadResearchSummaryReport?id=6225

- https://www.nseindia.com/option-chain

- https://in.tradingview.com/symbols/NSE-BANKNIFTY/

- https://www.pwc.in/assets/pdfs/viksit-banking-roadmap-indian-banking-sector-2047.pdf

- https://groww.in/options/nifty-bank

- https://www.goodreturns.in/news/stock-market-live-updates-sensex-nifty-likely-to-open-flat-on-july-29-gift-nifty-down-8-5-points-1445405.html

- https://tradesmartonline.in/tradeshaala/chapter/moving-average-indicators/

- https://www.ipsacademy.org/unnayan/20.pdf

- https://www.reuters.com/world/india/indian-rupee-bond-markets-cautious-week-dominated-by-fed-tariffs-2025-07-28/

- https://groww.in/p/moving-averages

- https://theprint.in/macrosutra/indian-banks-have-solid-asset-quality-profitability-for-now-but-risks-are-emerging-on-both-counts/2428059/

- https://economictimes.com/markets/stocks/news/fed-meet-q1-earnings-and-trump-tariffs-among-10-factors-to-impact-stock-markets-this-week/articleshow/122931362.cms

- https://zerodha.com/varsity/chapter/moving-averages/

- https://www.epw.in/engage/article/asset-quality-banks-looking-far-beyond-bad-banks

- https://www.moneycontrol.com/news/business/markets/sensex-down-300-pts-from-day-s-high-nifty-below-24-800-fii-selling-among-key-factors-behind-market-fall-13336580.html

- https://economictimes.com/industry/banking/finance/banking/banks-npa-to-worsen-but-sector-stress-testing-shows-sector-remains-well-placed-says-rbi/articleshow/122164019.cms

- https://www.5paisa.com/blog/sensex-nifty-stock-market-live-updates-july-29-2025

- https://www.business-standard.com/finance/news/bank-s-asset-quality-to-deteriorate-moderately-in-f26-and-fy27-moody-s-125031201101_1.html

- https://www.moneycontrol.com/stocksmarketsindia/

- https://www.topstockresearch.com/rt/Stock/BANKNIFTY/MovingAverage

- https://www.fitchratings.com/research/banks/rising-stress-in-unsecured-retail-poses-risks-to-indian-banks-asset-quality-23-01-2025

- https://www.reuters.com/business/finance/jane-street-likely-argue-retail-demand-drove-its-india-trades-bloomberg-news-2025-07-29/

Disclaimer: The information provided on this website is for informational purposes only and should not be construed as financial or investment advice. Users are advised to do their own research and consult a qualified financial advisor before making any investment decisions.